We’ve done a review and analysis of Governor Gavin Newsom’s 2019-20 Budget Proposal sent to you earlier today. While the proposed budget essentially includes the same amount of Proposition 98 spending as estimated by the Legislative Analyst’s Office (LAO) in November, there is some very good news in the budget for schools. Governor Newsom is providing significant assistance to school employers struggling with increases in the pension contribution rates. This assistance is outside of Proposition 98, so does not reduce expenditures for other priorities, including providing a 3.46% cost of living adjustment (COLA) for LCFF and other programs.

Highlights of 2019-20 Budget Proposal

- $143 billion in General Fund (GF) revenues in 2019-20

- $18.5 billion total state budget reserves ($15.3 billion in the Rainy Day Fund)

- $80.7 billion Prop 98 guarantee

- $3 billion one-time (non-Prop 98) payment for school employer CalSTRS liabilities

- 3.46% COLA applied to LCFF and categoricals

- Over $1 billion increased investment in early childhood services (details below)

- $576 million in Prop 98 GF ($186 million of which is one-time) for expanded special education services and support

- $1.5 billion in additional released school facilities bond funds authorized under Prop 51

Governor Newsom’s Approach

At his press conference earlier today, Governor Newsom repeatedly recognized former Governor Jerry Brown’s efforts to eliminate budget deficits, create a new budget surplus, and build a Rainy Day Fund to mitigate future economic downturns. He provided a more collaborative tone than Brown, giving credit to individual legislators who championed various issues (such as early learning, health care, pension costs, housing, etc.) that he highlighted in his press conference. Overall, Newsom was focused on finding the right balance between continued fiscal responsibility and increased investments in programs. With respect to fiscal responsibility, Newsom slightly lowered revenue projections for future years, prioritized paying off debts and decreasing liabilities, increased reserves and provided additional “Safety Net” funding. The Governor also highlighted several areas in which he hopes to see significant investments, including a $1 billion investment in a rebranded Earned Income Tax Credit (now the “Working Family Tax Credit”), subsidies to ensure middle-class Californians can afford health insurance, emergency and disaster preparedness and response, and of course, K-14 education.

Below we provide a brief summary and analysis of the budget proposal, including revenues, Proposition 98 spending, and policy and funding changes to K-12 programs.

Revenues, General Fund, Debts and Liabilities, and Budget Reserves

Due to continued growth in California’s economy, the Department of Finance (DOF) estimates approximately $143 billion in total 2019-20 GF revenues (including transfers pursuant to Prop 2), and has revised its estimates upward for 2017-18 by $3 billion and for 2018-19 by $2.7 billion. Before transfers, this amounts to an $8.1 billion increase in GF revenues over the three fiscal years, as compared to the 2018 Budget Act. In addition to allowing an increase in state GF spending, this significant influx of revenue generates additional 2019-20 Prop 2 transfers to the Rainy Day Fund budget reserve, and an equivalent amount to pay down state debts and liabilities.

Though this budget is based on the assumption of continued economic growth, it does note that economic uncertainties, and even the likelihood of a future economic downturn, have been increasing. As a result, Governor Newsom proposes a $700 million increase to the Safety Net Reserve created in the 2018 Budget Act, bringing the total in this reserve to $900 million.

The budget also includes a $1.77 billion mandatory transfer to the Prop 2 Rainy Day Fund, as well as $2.3 billion in the discretionary Special Fund for Economic Uncertainties. Combined, this brings total state GF budget reserves to $18.5 billion by the end of 2019-20. The budget also projects that the Prop 2 Rainy Day Fund alone will rise to $19.4 billion by 2022-23.

Under Prop 2, the $1.77 billion transfer to the Rainy Day Fund also triggers an equal $1.77 billion payment toward reducing state debts and liabilities; the budget proposes to meet this requirement by paying down the state’s retiree health and unfunded pension liabilities by that amount. In addition, Governor Newsom is proposing $4 billion to eliminate other state budgetary debts. Those actions include the full repayment of loans from special funds made during the Great Recession, and elimination of deferrals of state payroll and CalPERS payments also implemented during the recession.

Proposition 98 and LCFF

The DOF calculates the 2019-20 Proposition 98 guarantee to be $80.7 billion, an increase of $2.8 billion over the 2018-19 Prop 98 guarantee provided in the 2018 Budget Act. The DOF’s Prop 98 calculation is consistent with the estimate provided by the LAO in November 2018.

Due to continued declines in both average daily attendance (ADA) and GF revenue growth, the Prop 98 guarantees for both 2017-18 and 2018-19 are adjusted downward by $120 million and $526 million, respectively, in the Governor’s proposed budget. However, the Governor also proposes to hold K-14 education harmless with respect to those adjustments, by over-appropriating the guarantee in 2017-18 and using $686 million in Prop 98 settle-up funds to cover what could have been a reduction in funding for 2018-19.

Growth in Prop 98 allows the Governor to cover a 3.46% COLA, providing a $2 billion increase to district and county office of education LCFF allocations and a $187 million increase for certain categoricals. This growth also allows additional funding to expand special education services, further support the state’s new accountability system, begin to rebuild the state’s education data systems, and support his early learning agenda.

Despite this growth in spending and the one-time funding to “buy-down” employer contribution rates in CalSTRS, there remains a growing interest among school advocates to focus on addressing California’s woefully insufficient per-pupil spending. Concerns about funding levels are particularly acute given the rapid increase in the costs of running schools, including everything from pension to health benefits to transportation to education technology expenses. Discussions continue to focus on creating new funding goals, perhaps a new LCFF target that moves California closer to the per-pupil funding provided by the top 10% of states. Even after all of the increases in the Prop 98 guarantee since the Great Recession, “full implementation” of the LCFF, and continued growth in Prop 98, California remains in the bottom 10% of states in cost-adjusted per-pupil spending.

Immediate Reduction in CalSTRS Employer Contribution Rate

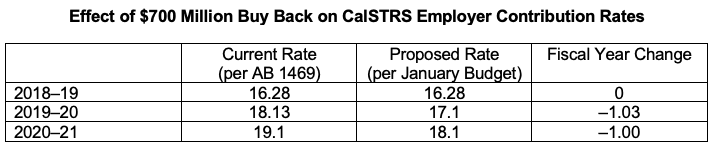

By proposing to invest $3 billion in one-time funds towards K-14 pension liabilities, the Governor hopes to free up billions of dollars in operational funds for school districts: $700 million over the next two years and approximately $6.9 billion over the next three decades.

For years, school districts and county offices have underscored the need bolster the financial sustainability of not only the underfunded pension systems, but local education agencies (LEAs) themselves, due to rising pension costs. Governor Newsom’s first budget validates and responds to those concerns.

In the short-term, a total of $700 million from the non-Proposition 98 side of the budget will be provided to buy down the employer contribution rates in 2019-20 and 2020-21, the final two years of the CalSTRS funding plan’s statutory rate increases. By offsetting these rate increases, the Governor will keep an equivalent amount of money in the classroom.

The Budget also proposes to invest $2.3 billion towards school employers’ long-term unfunded liability at CalSTRS. The prepayment is expected to reduce contribution rates by 0.5 percent (ongoing), or approximately $6.9 billion over the next three decades.

Elsewhere, the Budget proposes $5.9 billion in GF expenditures to address the state’slong-term pension liabilities—including a one-time $3 billion cash supplemental pension payment to CalPERS and $2.9 billion (using Proposition 2 funds) over the next four years to CalSTRS. These supplemental pension payments are intended to curb the growing costs of the state’s retirement programs and are estimated to result in $14.6 billion in savings over the long term.

Early Childhood Expansion

As promised on the campaign trail, Governor Newsom proposes to expand child care and early learning programs.

State Preschool

As a step towards his goal of universal preschool in California, the Governor proposes to increase access to the existing State Preschool Program for all low-income four-year-olds. Specifically, the Administration proposes to:

- Provide $124.9 million non-Prop 98 GF in 2019-20 and additional investments in the next two state budgets to fund a total of 200,000 preschool slots by 2021-22.

- Eliminate the existing requirement that families of four-year-olds provide proof of parent employment or enrollment in higher education to access full-day programs.

- Shift $297.1 million Prop 98 GF for part-day State Preschool Programs at non-LEAs to non-Prop 98 GF, to allow non-LEA providers to draw down full-day, full-year reimbursement from a single funding source and to provide the flexibility to make better use of their contract funding.

Full-Day Kindergarten

The Governor proposes $750 million one-time non-Prop 98 GF for eligible school districts to build or retrofit facilities for full-day Kindergarten programs. See the Facilities section below for additional information.

Child Care

The Administration proposes $500 million one-time non-Prop 98 GF to expand subsidized child care facilities in the state and improve the education and professional development of child care providers. The Governor also proposes $247 million in one-time funds to the California State University to be used for child care infrastructure for students on college campuses.

The Administration also proposes $10 million GF for the state to contract with a research and analysis entity to develop a road map to provide universal preschool in California, as well as a long-term plan to improve access to and quality of subsidized child care.

CalWorks Stage 2 and 3 Child Care

The Governor proposes a net increase of $119.4 million (non-Prop 98) to reflect an increase in the number of CalWORKs child care cases. Total costs for Stage 2 and 3 are $597 million (Stage 2) and $482.2 million (Stage 3).

Child Savings Accounts (CSAs)

The Administration proposes $50 million one-time GF (non-Prop 98) to support pilot projects and partnerships with First 5 California, local First 5 Commissions, local government, and philanthropy to increase access to CSAs for incoming kindergartners.

More details on these proposals can be found in the Budget Proposal in the Child Savings Account proposal, child care programs funding chart, and the child development programs funding chart.

School Facilities

School Facilities Bonds

In a major reversal from the prior administration, Governor Newsom proposes to issue $1.5 billion in Proposition 51 (2016) bonds next year and increase the Office of Public School Construction’s funding by $1.2 million to speed the processing of applications. This shift reflects—almost exactly—the requests by the educational advocacy community over the past two years. It also reflects a $906 million year-over-year increase in bond sales compared to the current fiscal year.

Facilities Funding to Implement Universal Full-Day Kindergarten

Citing the long-term academic benefit of children attending full-day, high-quality early primary education programs, the Governor proposes $750 million in one-time, non-Prop 98 GF to eligible school districts to construct new or retrofit existing facilities for full-day kindergarten programs or “to fund other activities that reduce barriers to providing full-day kindergarten.” This would build on last year’s $100 million grant program for full-day kindergarten facilities.

Potential Threat to District Developer Fees

In response to the housing crisis—both supply and affordability—the Governor has highlighted the need to address local developer fees, which he believes contribute substantially to the cost of development. It is not clear the Governor was referring to developer fees used to cover the costs of building new schools, incurred when home construction creates local demand for educational facilities. The Governor stated in his budget presentation that he will create a taskforce on the subject.

Accountability, Data, and the Statewide System of Support

County Offices of Education

COEs were given a major role to play in the overhaul of the state’s accountability system. To support the role COEs play in supporting their districts, the proposal provides an increase of $20.2 million Prop 98 GF dollars, consistent with the formula that was adopted in last year’s budget.

Improved and Expanded Data Systems

Governor Newsom put a high priority on improved educational data systems throughout his campaign. Reflecting that priority, the budget proposal provides $10 million to plan and begin development of a longitudinal data system that would integrate existing data systems to provide more comprehensive information on how students are progressing from cradle to career.

Promoting User-Friendly Accountability Systems

To promote community interaction with the electronic pieces of the accountability system, the Budget Proposal provides $350,000 one-time money to merge the Dashboard, the LCAP electronic template, and other reporting documents, including the School Accountability Report Card.

Special Education

The administration proposes an infusion of $576 million Proposition 98 GF dollars, of which $186 million is proposed as one-time. This is more than likely a response to annual calls from special education advocates that the system is administratively burdensome, underfunded, and too often ineffective at increasing academic performances of those it serves.

These new grants will be focused on LEAs with high concentrations of either special education students or unduplicated pupils. Allowable expenditures of these dollars appear to be fairly broad, and can range from special education supports outside of an existing individualized education program to preventive measures that might lessen future needs. The Administration is not proposing any major structural shifts in the way special education services are provided across the state.

0 Comments